Maputo, 14 Aug (AIM) – The prominent anti-corruption NGO, the Centre for Public Integrity (CIP), believes that the alleged freezing of the exchange rate by the Bank of Mozambique, in its role as regulator of the national financial system, is contributing to the shortage of foreign currency (particularly of US dollars) in the national banking system.

Recently, the Confederation of Mozambican Business Associations (CTA) warned that a shortage of foreign currency is one of the main constraints on the efficient operation of productive sectors, particularly manufacturing, commercial agriculture, tourism, mining, and logistics. The shortage has been leading to partial or total shutdowns of operations, job losses, and reduced tax revenues.

According to a study carried out by CIP, the freezing of the exchange rate has also led commercial banks to restrict the sale of foreign currency “although there is an abundance of foreign currency in the informal market, but at a high price.”

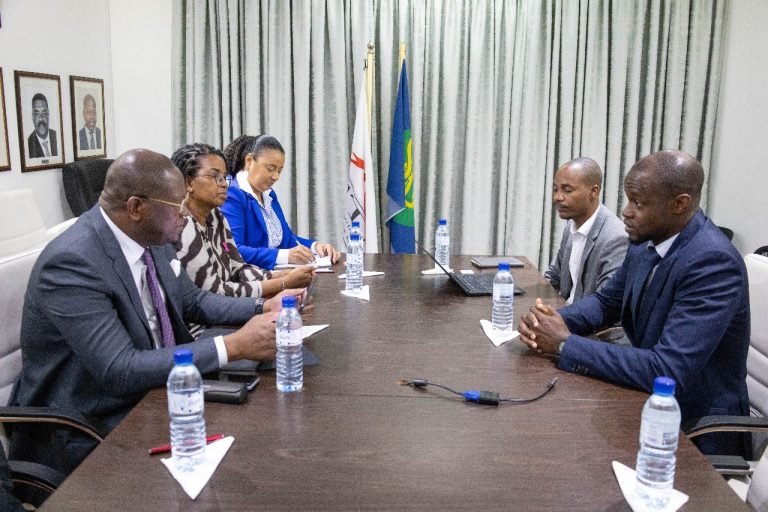

According to the economist Teresa Boene, speaking on Wednesday, in Maputo, during the presentation of the preliminary study on the shortage of foreign currency, commercial banks and exchange houses have run out of foreign currency, while in the informal market, foreign currency is readily available.

“Those (companies or individuals) who hold foreign currency retain it and engage in speculation because the Bank of Mozambique is freezing the exchange rate”, claimed Boene. “This means that those who hold foreign currency are keeping it in the hope of future depreciation of Metical”.

Boene said that commercial banks, companies, and individuals holding foreign currency arbitrarily “prefer to sell it on the parallel market, where the exchange rate is high”.

According to CIP, alongside the alleged freezing of the exchange rate since 2021, there have been strict control measures by the Bank of Mozambique, such as an increase in reserve requirements.

The measures adopted by the central bank, the analysis says, have had a negative impact on the economy and households “since a few months ago, at least 60 companies saw their invoices worth 23.2 billion Meticais go unpaid due to a lack of foreign currency.”

“As a result of the lack of foreign currency, companies are facing difficulties in producing goods, which is causing an increase in the prices of goods and services and, consequently, an increase in the cost of living. This crisis increases unemployment, which in turn will increase poverty”, the economist said.

CIP believes that in order to reverse this scenario, there is an urgent need to revise the exchange rate policy, but this should start from strengthening tripartite dialogue between the Bank of Mozambique, commercial banks and economic agents, “as well as strengthening national production and promoting alternatives for attracting foreign exchange.”

(AIM)

Ad/pf (456)